In light of these unusual times I just wanted to shoot you a slightly different report including some information we have gathered from various sources pertaining to the effects of the coronavirus on the real estate market.

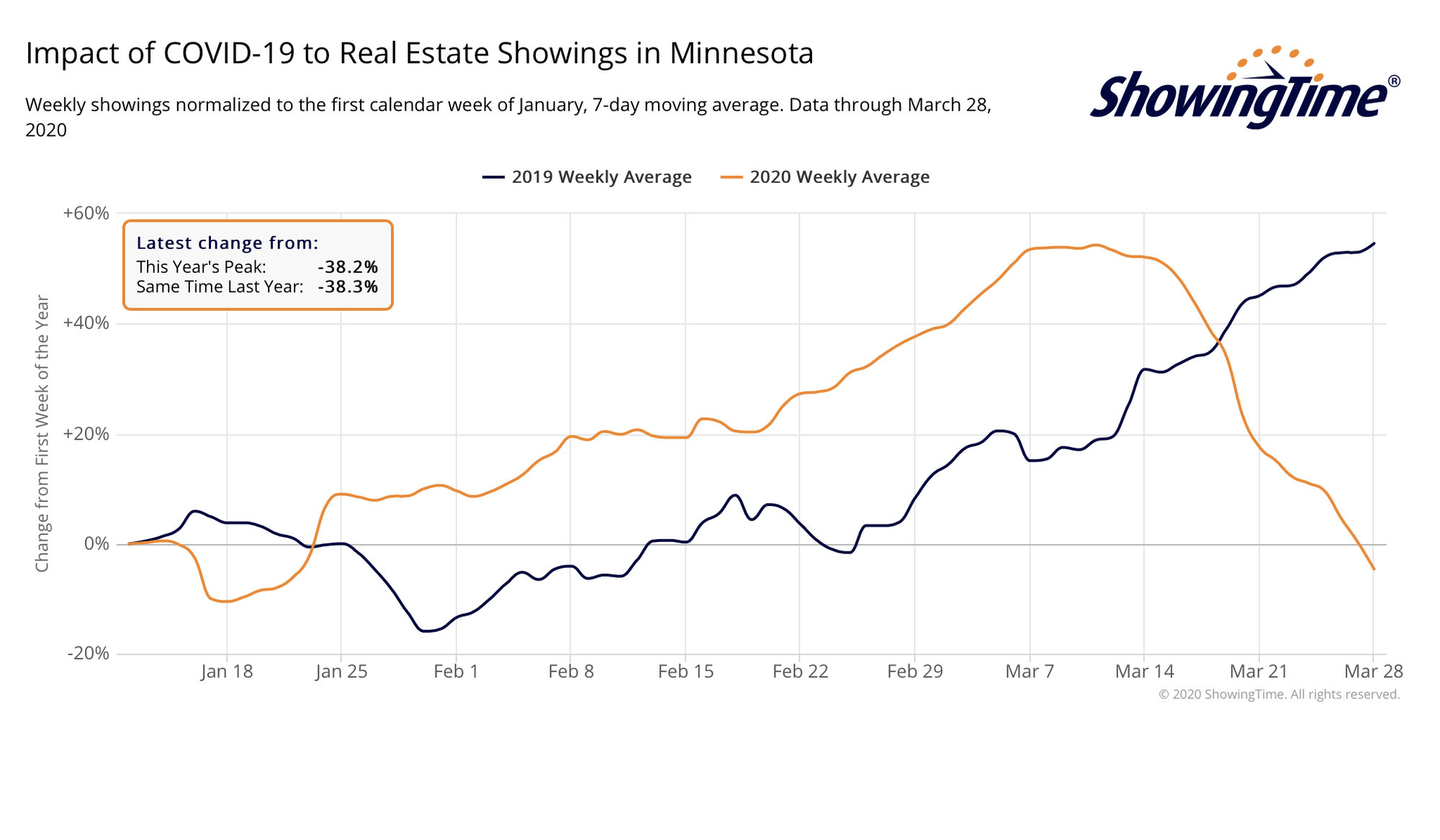

Showing Activity in General

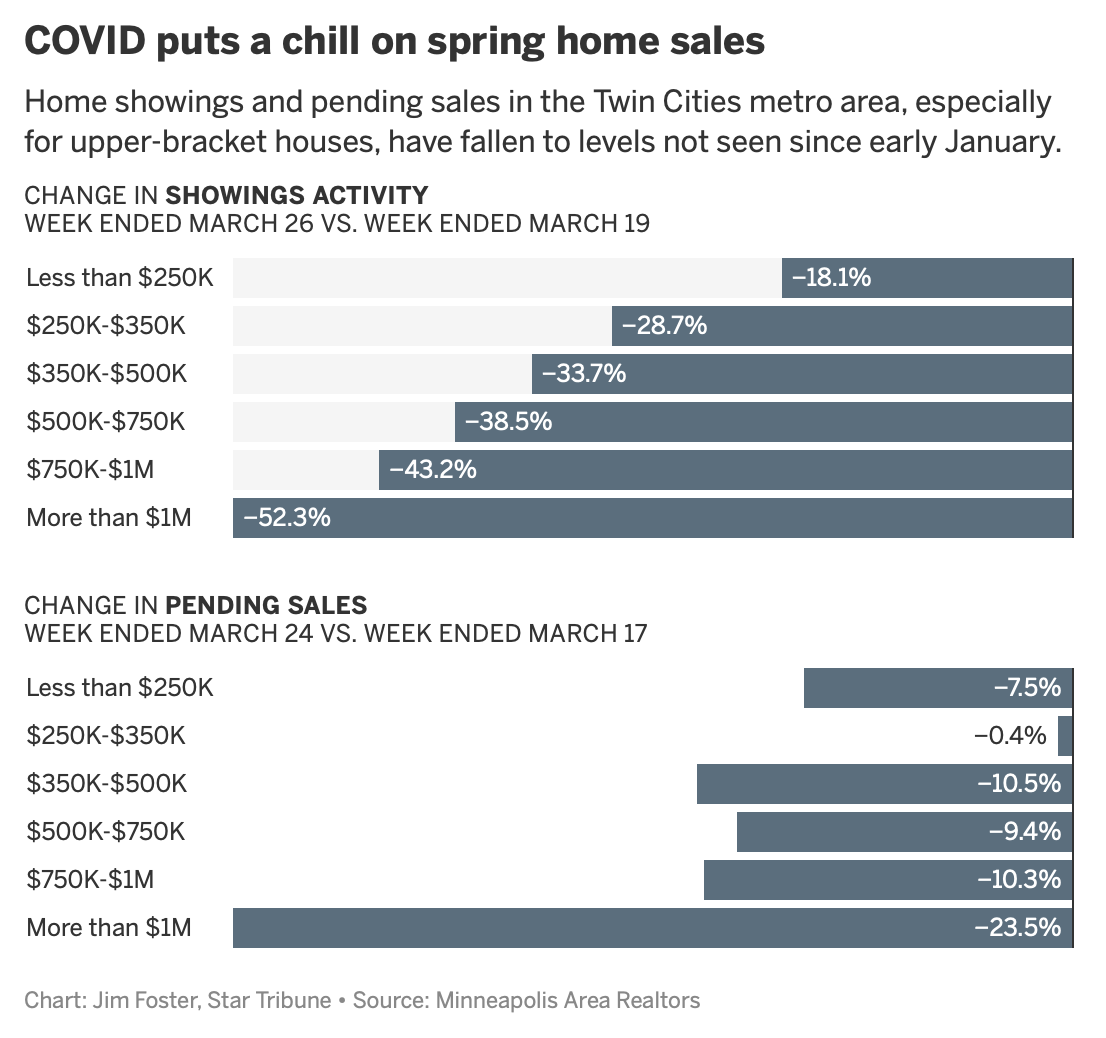

Showing activity is down as are the pending listings but they are are not tracking each other exactly. There are fewer showings but the buyers that are out there are presumably more serious (which you will see in the chart published by the star tribune earlier this week - below). You will notice different price points are being affected differently as well.

That combined with sellers possibly re-financing and staying where they are or waiting for things to blow over may present an opportunity for sellers if the inventory continues to tighten up. This will be something to watch over the next couple of weeks. We are still seeing multiple offers under 400k in certain areas of the market (my personal experience this week was with single family homes in areas of Golden Valley and St Louis Park).

An article in the Start Trib reported that there have been several homes agents haven’t been able to show buyers because sellers had placed their homes in “temporarily not available for showing” (TNAS) status as they wait things out. Last week there were over 120+ homes that reportedly went TNAS.

The right path will of course depend on how things progress with the virus, market contentions etc. If you are in a condo building there are likely different protocols put in place to protect residents over the next few weeks. We will be working with your associations to make sure that buyers agent are aware of any such policies. We will also be watching the market in general, leaning on the professionals within our sphere and report to you with the information as we get it.

The bottom line is real estate services have ben deemed essential so product is still trading, just with less activity and different parts of the market are hotter than others right now. We are taking every measure to make sure you are safe and that we are taking the best path possible.

Interest Rates

Rates that traditionally track the bond market have bounced between the low 3% range and roughly 4.1 due to the investors raising the floor to respond to the influx of refinances when they initially dropped a few weeks back. The good news is that interest rates are still excellent right now. We are currently seeing the “millennial” first time home buyers fueling the real estate market taking advantage of these great rates.

Why have rates been volatile? Rates were near 3% and then 4%….

Think of banks or mortgage companies as having a large credit card to lend out mortgages with. Each company will sell the mortgages to investors or wall street to free up the limit on their “credit card.” Some companies can’t sell the mortgages fast enough and they are at the limit of their “credit card.” This is why we saw interest rates increase a week or so ago and why some local companies have limited how many loans their loan officers can complete because they can’t take more loans until they sell off some of the mortgage loans that are still on their credit line, pushing the credit limit. *The Lisa Wells Team at CrossCountry Mortgage

How are agents conducting showings, closing etc?

We can’t speak for the industry in general but it appears things are going more virtual. DRG has responded to the situation by following the guidelines in the graphic below. This will likely be the process in general in the coming weeks. We are taking this seriously. We are also offering our Virtual Realty walkthroughs. The tech has been there for a while now but with everything going on buyers will be utilizing these more frequently than in the past. We are committed to making sure we are getting ahead of the trends for you and leveraging them for ultimate exposure.

Whether buying or selling in this market, we have the tools, skills and answers to your questions. Don't hesitate to reach out with any questions you may have! We're here for you.

-The Seebinger Group

Posted by Mike Seebinger on

Leave A Comment